A new paradigm: when waste becomes an asset

Imagine if waste stopped being a problem for companies and became a source of income. This is not a futuristic idea but an increasingly tangible trend.

In a world where natural resources are finite and waste is growing exponentially, the transition towards a circular bioeconomy stands out as an essential pillar for a sustainable future—especially considering that every year, millions of tonnes of agri-industrial by-products, food waste, and organic streams remain underused, despite their high content of carbon, nutrients, and valuable compounds.

10% of food available for consumption in the EU is wasted in the supply and consumption sectors

So much so that it is estimated that around 10% of food available for consumption in the EU is wasted in the supply and consumption sectors (households, food service, and retail), according to Eurostat, the Statistical Office of the European Union. But what if this waste, far from being a problem, could be turned into an opportunity—and become the raw material of the future?

Each year, around 59 million tonnes of food waste are generated in the EU, equivalent to 132 kg per person, with an estimated economic value of €132 billion (Eurostat, 2022). Behind these figures lies an opportunity for innovation: transforming this waste into bioplastics, organic acids, proteins, or biofuels capable of replacing fossil-based derivatives and reducing the industry’s carbon footprint—potentially meeting up to 20% of its demand for basic chemicals with renewable carbon.

20% of the industry’s demand for basic chemicals could be met with renewable carbon

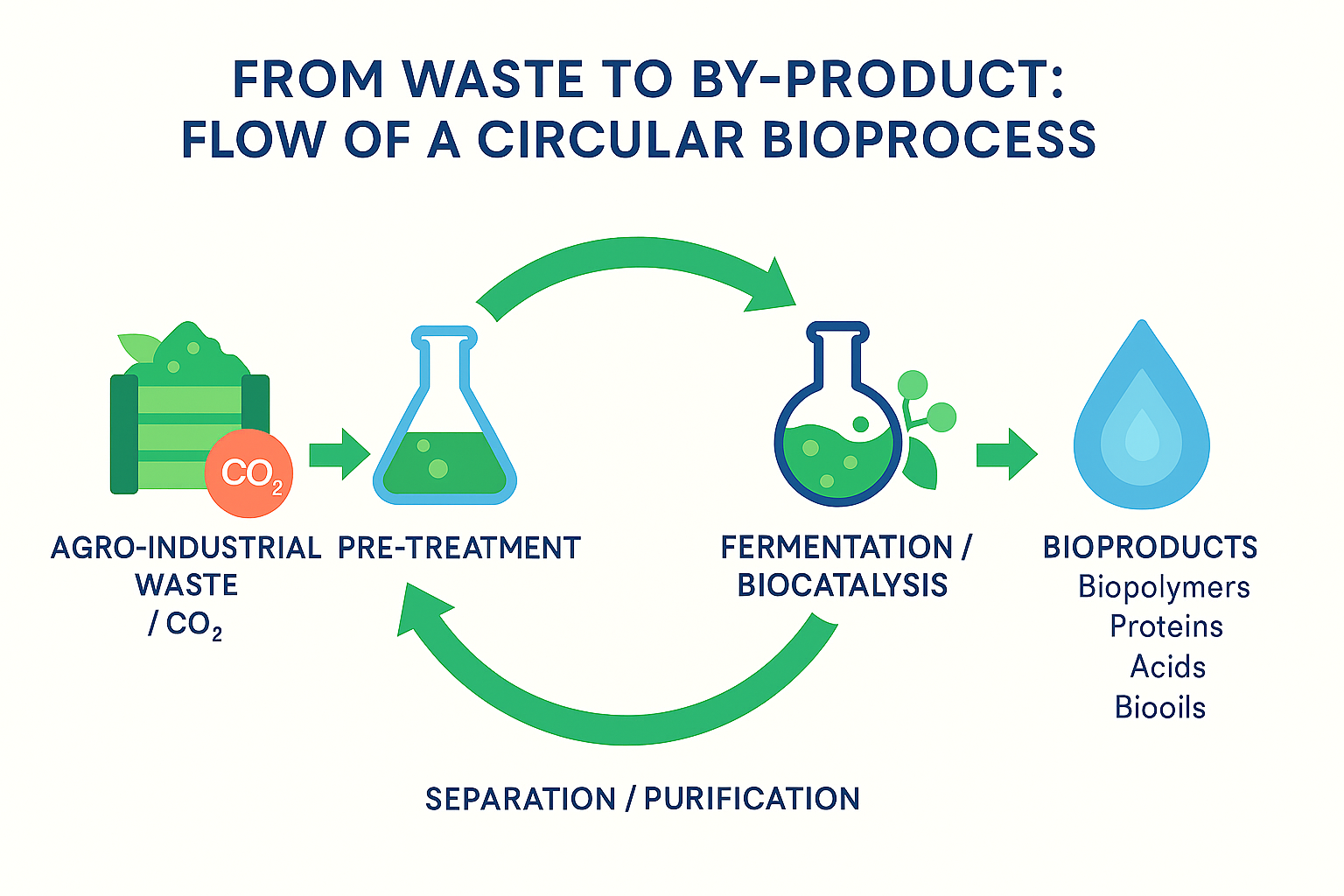

The concept of a circular bioprocess goes beyond recycling. It involves redesigning production flows so that each carbon molecule has more than one life. As highlighted in the European Bioeconomy Strategy (2024–2025), the challenge lies in turning agricultural and urban waste into feedstocks for new bioproducts, thereby reducing impacts on soil, water, and biodiversity.

This momentum is being reinforced by new regulations: the Packaging and Packaging Waste Regulation (PPWR), which will take general effect in August 2026 and requires all packaging to be recyclable or reusable (Design4Recycling). This regulation is creating a ripple effect throughout the value chain, where the demand for bio-based and recyclable materials is growing at an unprecedented pace.

From waste to resource, or how to turn waste into valuable molecules: the technology that makes it possible

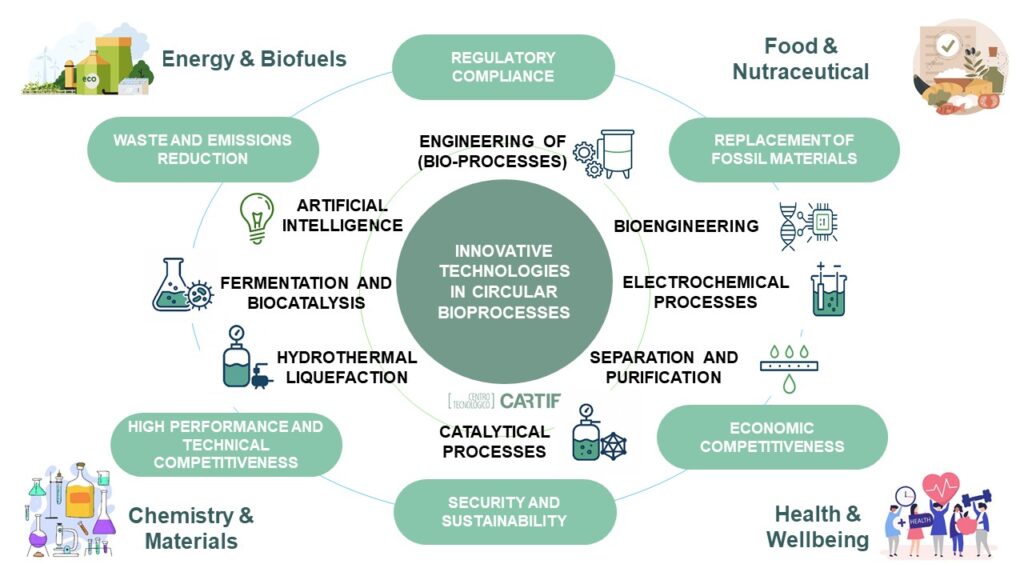

Industrial biotechnology is today an essential tool for transforming organic waste, lignocellulosic biomass, or even CO₂ emissions into high value-added molecules. This conversion is achieved through platforms that combine microbiology, catalysis, and green chemistry. In CARTIF’s Biotechnology and Sustainable Chemistry (BQS) area, the process is structured around four main stages:

- Smart Pretreatment: The first step is to break down the complex structure of the waste (lignocellulosic biomass, molasses, used oils) through physical, chemical, or enzymatic methods to release sugars and fermentable compounds.

- Advanced Fermentation: At this stage, engineered microorganisms convert substrates (sugars, CO₂, syngas) into organic acids, biopolymers, alcohols, or single-cell proteins (SCP). This is a critical step, as productivity, selectivity, and stability determine the feasibility of the process.

- Selective Biocatalysis: To convert an intermediate metabolite into a final molecule of interest, specific enzymes or biocatalytic pathways are used. These operate under mild conditions and increase the purity of the final product.

- Separation and Purification Stage (Downstream): Membranes, chromatography, ultrafiltration, or spray drying techniques are used to isolate, concentrate, and prepare the product to meet industrial and quality regulatory requirements.

When all these processes are integrated into a biorefinery —which simultaneously produces several bioproducts from a single waste stream— carbon use is maximized, while costs, emissions, and risks associated with fossil raw materials are reduced.

In the Biotechnology area, we work with methodologies based on the development of technologies at the laboratory scale for subsequent scaling up to pilot plant and pre-industrial phases (TRL 2–5). These are accompanied by techno-economic analysis and carbon footprint assessment tools to ensure that innovation is both scalable and transferable to industry and the productive sector.

Technologies that generate value and market

It is not enough for a process to work — it must produce competitive products in terms of volume, cost, and quality. Circular bioprocesses make it possible to access growing industrial markets. Among the bioproducts with the greatest commercial potential are:

Organic acids (lactic, acetic, succinic): building blocks for the chemical, cosmetic, and bioplastics industries.

PHA/PHB biopolymers: biodegradable alternatives with high potential in sustainable packaging.

Microbial proteins: a source of alternative protein for animal feed or aquaculture.

Natural antioxidants and bioactive peptides: high-value ingredients for nutraceuticals and cosmetics.

Bio-oils and biochars: precursors for adhesives, coatings, or porous materials.

The European market has already begun to turn interest into figures: with a high growth rate, competition among biotechnological producers is increasingly focused on niches where local supply chains, sustainability, and traceability are differentiating factors compared to fossil-based plastics.

In 2024, the packaging sector accounted for 45% of the demand for bioplastics in Europe (European Bioplastics). Forecasts point to an annual growth rate of 18% between 2025 and 2030, increasing from 0.67 to 1.54 million tonnes. Other segments, such as bioactive ingredients and technical biopolymers, are also joining this momentum, where traceability and renewable origin have become key competitive advantages.

What CARTIF contributes: infrastructure and risk mitigation

Turning a good idea into a viable industrial project requires an advanced technological platform, flexibility, and expertise in scale-up processes. This is where CARTIF contributes the experience of its highly qualified technical staff and its comprehensive laboratory and pilot plant infrastructure.

The Biotechnology and Sustainable Chemistry (BQS) area has a complete infrastructure that enables the scaling of processes from laboratory to pilot plant, featuring automated fermenters (1–200 liters), pressurized reactors capable of using gases such as CO₂ / H₂ / CO, SCADA systems, and a state-of-the-art analytical laboratory (HPLC, GC-MS, UPLC-MS, FTIR, SEM, TGA, etc.).

With these capabilities, we can simulate industrial conditions, optimize key parameters (yields, productivity, enzymatic/energy costs), and validate feasibility before scaling up.

From idea to project: recommended roadmap

For those working in companies, clusters, or technology centers, this quick guide can help design a strategy to valorize and benefit from by-product and waste streams:

1. Identify your residual streams: analyze their composition, volume, and variability.

2. Define your product portfolio: select one or two “anchor products” plus potential co-products.

3. Choose a technology and develop it with innovation and competitiveness criteria — from laboratory to pilot scale — with clear KPIs such as productivity, titers, and gross/net yield.

4. Conduct economic (TEA) and environmental (LCA) assessments under relevant regulatory scenarios.

5. Secure supply and off-take agreements with suppliers and distributors.

Thanks to its multidisciplinary expertise and collaborative network with companies, CARTIF supports industry throughout the entire development cycle — from waste characterization to pilot validation and techno-economic evaluation — applying an integrated approach that reduces technological risk and accelerates the transfer of results to the market.

📩 Contact us to develop biotechnology solutions tailored to your industry

In summary, biotechnological waste valorization is no longer a futuristic promise: it has become a necessary strategy for companies seeking to stay ahead of regulations, reduce costs or environmental reputation risks, and capture new market niches. With strict regulations such as the PPWR coming into force and ambitious targets set for 2030, those who integrate circular bioprocesses will gain a solid competitive advantage.

Circular bioprocesses offer a real pathway to transform environmental challenges into opportunities for innovation. At CARTIF — and specifically within the BQS area — we work to ensure that every molecule counts, driving a more sustainable, competitive, and knowledge-based industry.

- Circular bioprocesses: how to transform waste into high-value bioproducts - 31 October 2025

- The green molecule revolution - 15 November 2024

- Biogenic CO2: challenges and opportunities for a sustainable future - 19 April 2024