In 2020, Spain took a firm step towards decarbonisation with the publication of the National Integrated Energy and Climate Plan (PNIEC). Among the measures highlighted, renewable hydrogen or green hydrogen, i.e., hydrogen generated in electrolysers powered by renewable energy, emerged as a key solution to reduce emissions in various sectors.

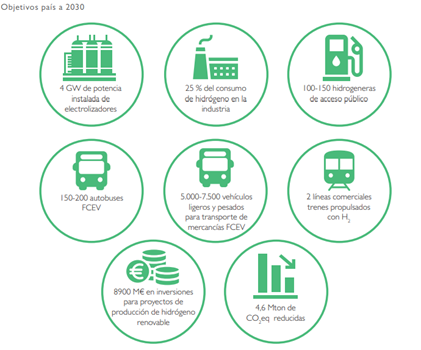

One of these measures was the publication of a Hydrogen Roadmap, which sets out concrete strategies to avoid CO2 emissions through hydrogen, replacing fossil fuels in uses such as heat generation for industry or housing, or as fuel in means of transport such as lorries or ships. It also sets targets for hydrogen use by 2030, including having 4 GW of installed capacity of electrolysers and replacing 25% of the hydrogen consumed in industry with green hydrogen.

Thanks to these policies, both both local and international companies will start to invest in hydrogen, proposing projects with electrolysers of up to 100 MW to supply peninsular consumers. European programmes will help finance these projects, although they will also depend to a large extent on private investment.

European Union policies on hydrogen

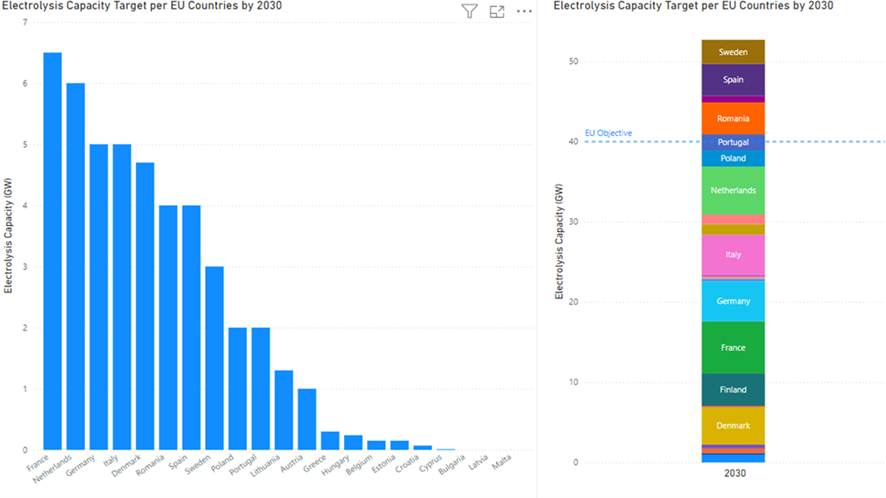

The European Comission adopted its hydrogen strategy in July 2020, calling for a total of 40 GW of electrolyser capacity for the whole region by 2030, and hydrogen consumption accounting for 24% of all final energy by 2050. In addition, through other policies such as the “Fit for 55” package or RePowerEU, it will set an objective of 10 Mt of hydrogen generation and 20 Mt of consumption; 75% substitution of fossil fuels with renewables (including hydrogen) in industry and 5% in transport; and construction of up to 28,000km of hydrogen exchange pipelines, all by 2030.

Programmes are also being created to finance the installation of hydrogen infrastructure, such as “Hy2Tech” or “Hy2Infra”, which, between different calls for public and private funding, have raised more than 38 billion euros; as well as institutions designed to vridge the price gap that green hydrogen currently has, such as the European Hydrogen Bank.

Figure 2 shows the installation objectives of the different EU countries, which together manage to exceed the overall target for the region. Countries such as France and the Netherlands plan to reach up to 6GW of national capacity, followed by Germany, Italy and Denmark with 5 GW, or Romania and Spain with 4 GW.

According to the 2024 Global Hydrogen Review published by the International Energy Agency, the current installed capacity in Europe is 2 GW, leaving the 40 GW target a long way off. The challenges of financing for large infrastructure, electrolyser manufacturing capacity and connecting hydrogen producers and consumers need to be overcome to boost this growth.

Hydrogen policies in the rest of the world

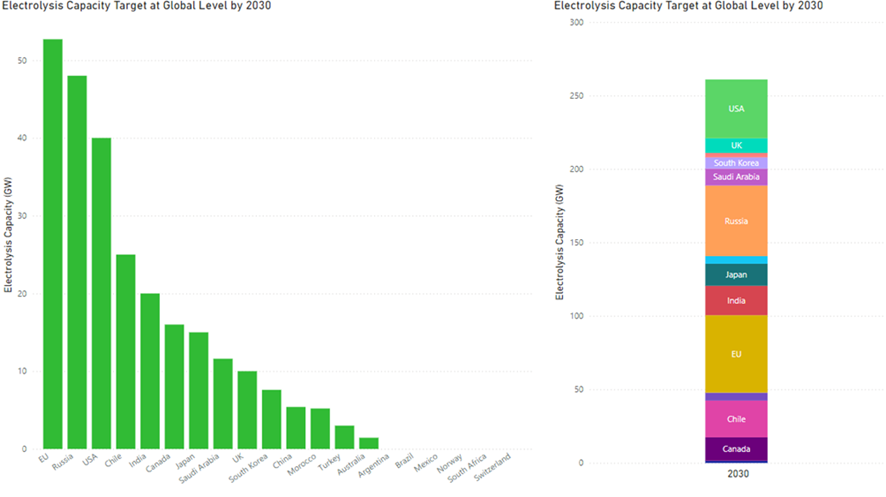

At a global level, goverments´ concern for the energy and environmental situation has drivenpolicies and strategies for decarbonisation using renewable hydrogen. Not only large hydrogen producing and consuming countries, but also countries that see hydrogen as a great opportunity for development and economic growth, thinking about the posibility of international trade.

Figure 3 shows the electrolysers installation targets of other countries compared to the EU, together reaching more than 250 GW. Regions such as Europe, Russia and USA will try to reach more than 40 GW of generation, but also countries such as Chile, India or Canada are planning large investments, taking advantage of the opportunity to trade with hydrogen.

Achieving the proposed targets, especially considering that we are halfway through many of them, is a considerable challenge. Of the 520 GW of projects announced for 2024, only 20 GW have reached the final financing decision, making this the biggest challenge to hydrogen penetration. As for electrolyser manufacturing capacity, it currently stands at 5 GW, although it has increased ninefold since 2021. The challenges are great, however, the global commitment and the desire to lead this energy revolution keep the commitment to hydrogen as a transformational solution alive.

The future of hydrogen in Spain

Spain updated the PNIEC in 2023, increasing the objective for electrolysers capacity to 12 GW by 2030, more than a quarter of the total European Union target. Spain currently has an installed electrolyser capacity of 35 MW, and has the largest industrial electrolyser in Europe: a 20 MW electrolyser located in Puertollano, Ciudad Real. However, for the time being it depends on external electrolyser manufacturers.

“Spain has the largest industrial electrolyser in Europe. 20 MW located in Puertollano, Ciudad Real”

This commitment reinforces the need to careful planning to maximise the economic, environmental and social benefits of this revolution. Despite progress in funding and project approval, further analysis of the impacts of hydrogen on the economy, land use and society is still needed.

Thanks to the use of Integrated Assesment Models, we can simulate complex scenarios and assess the effects of this transition, ensuring data-driven planning with a holistic sustainability perspective. At CARTIF, we work to understand and optimise the role of hydrogen in the energy transition. Through HYDRA project (no. GA 101137758), we have analysed hydrogen policies at European and global level, using Integrated Assesment Models (IAMs) to explore how this technology can be sustainably integrated into different sectors.

The implementation of policies such as RePowerEU and support for “hydrogen valleys” demonstrate a strong commitment to the development of this technology. However, international collaboration and strategic planning will remain essential to maximise its positive impact.

Renewable hydrogen represents a unique opportunity to transform our energy model and move towards a cleaner and more sustainable economy. At CARTIF, we continue to research and developsolutions that makes this vision a reality.

The future of hydrogen is now! Join the revolution and discover how this technology is changing the world.

- Hydrogen objectives are being met? - 24 January 2025